Tax Filing Software

Strengthening Nonprofits Together: AZ Impact for Good Partners with Tax990

AZ Impact for Good is partnering with Tax990, an IRS-authorized compliance and e-file provider custom-built for nonprofits. This partnership comes in response to member requests for reliable, affordable filing support.

With Tax990, you don’t need to learn the tax code—we handle the never-ending complexities of taxes for you. Our easy-to-use software ensures that you’re filing the latest forms and following the latest rules. We’ll even help you refile for free if anything is wrong.

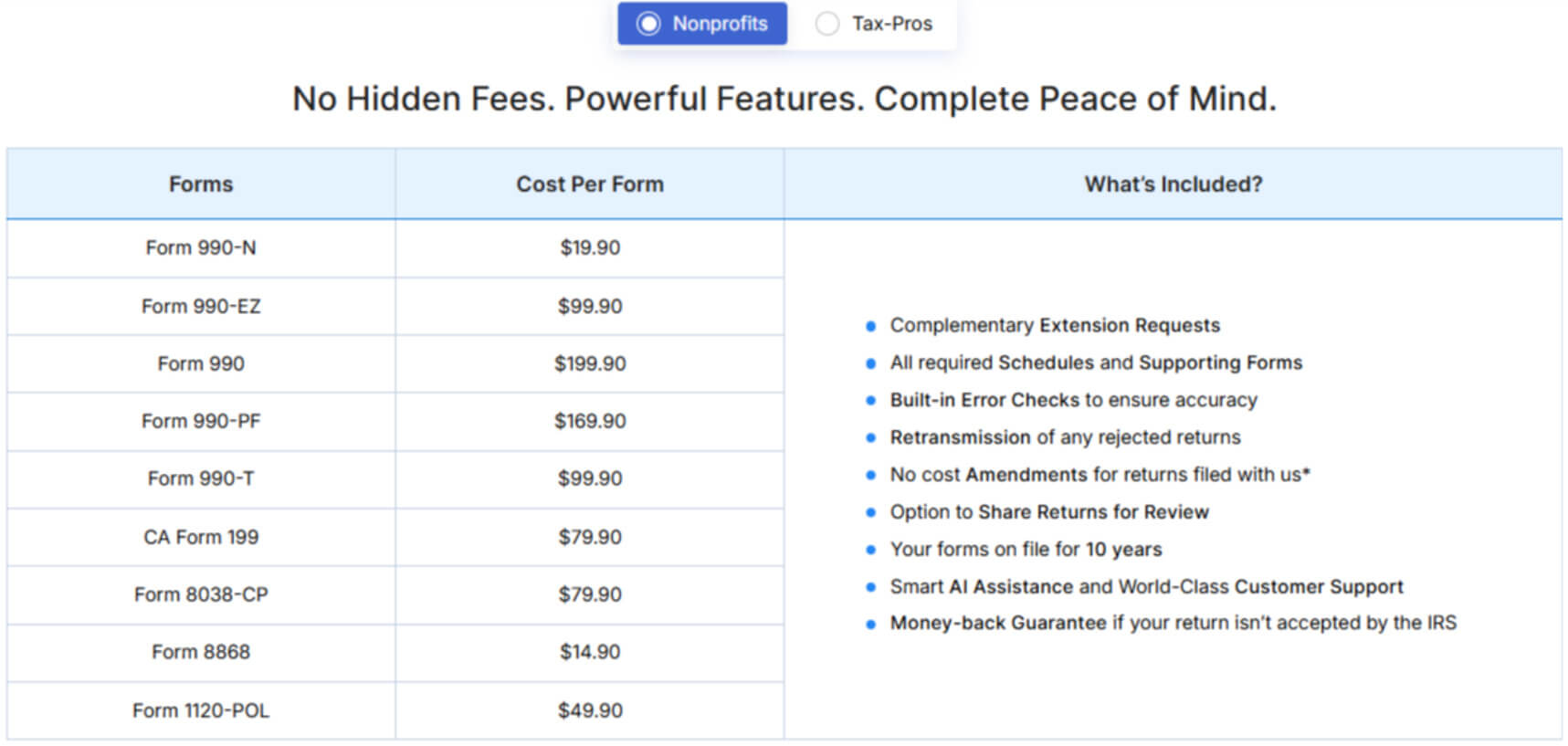

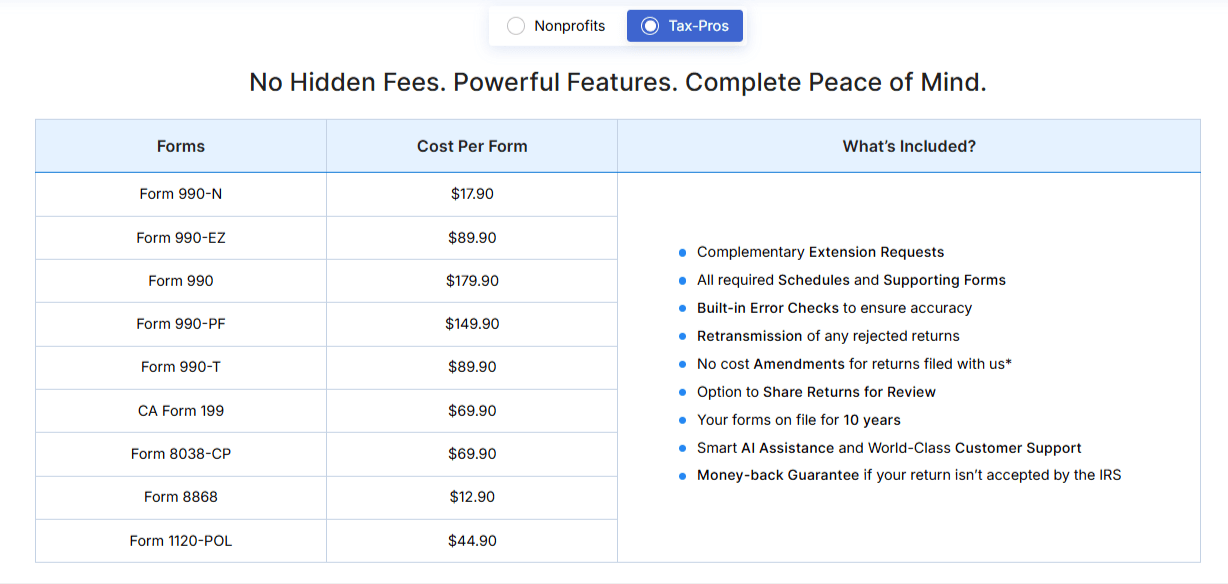

Unlike subscription services, Tax990 offers a pay-per-form fee structure—you only pay for what you file. And if you need assistance, you can count on top-tier live U.S. customer support to guide you every step of the way.

Economical prices for both nonprofits and tax professionals!

We’re here to support Arizona nonprofits with reliable, affordable tax filing—so your organization can stay focused on its mission and keep doing good.

The Tax990 Commitment:

Form 990 Accepted, Every Time—Nonprofit Tax Filing Made Simple

We do everything in our power to help you get your return IRS-approved.

- Complimentary extensions

- No cost amendments

- Free retransmission of rejected returns

- Guaranteed approval or money-back

File your 990 confidently, backed by our commitment